NTPC Share Price : The domestic equity indices BSE Sensex and NSE Nifty-50 started negative on Monday, April 7, 2025, amid mixed trading in the global stock market today. On the opening bell on Monday, April 7, 2025, the BSE Sensex slipped -2226.79 points or -3.04 per cent to 73137.90 and the NSE Nifty slipped -742.85 points or -3.35 per cent to 22161.60.

On Monday, April 7, 2025, by around 03.30 pm, the Nifty Bank index fell by -1642.60 points or -3.29 per cent to 49860.10. The Nifty IT index fell by -842.60 points or -2.58 per cent to 32668.80. However, the S & P BSE Smallcap index fell by -1892.81 points or -4.30 per cent to 43974.36.

NTPC Share Price Today

| Market Cap | ₹3,39,819.66 Cr | ROE | 13.12 |

| P/E Ratio (TTM) | 15.46 | EPS (TTM) | 22.67 |

| P/B Ratio | 2.02 | Dividend Yield | 2.21 |

| Industry P/E | 22.76 | Book Value | 173.54 |

| Debt to Equity | 1.44 | Face Value | 10 |

Monday 7 April 2025 NTPC Share Status

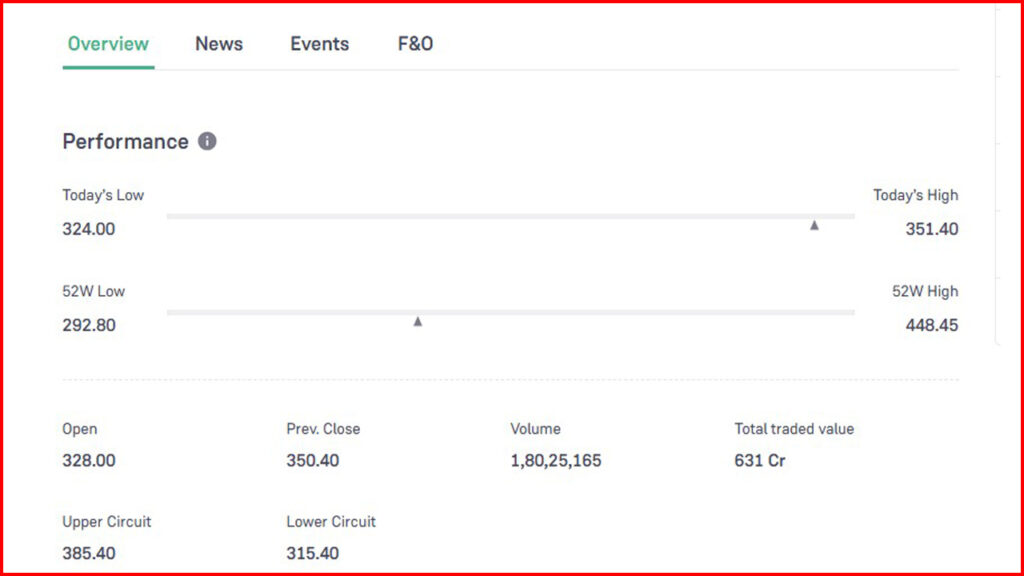

At around 03.30 am on Monday, the stock of NTPC Limited company fell -0.19 per cent and was trading at Rs 349.75. The NTPC stock opened at Rs 328 as soon as trading started on the stock market on Monday morning. By 03.30 pm today, the NTPC company stock rose to a day high of Rs 351.4. At the same time, the low level of the stock was Rs 324 on Monday.

NTPC Share Range

As of today Monday, April 7, 2025, NTPC Limited Company stock had a 52-week high of Rs 448.45. The stock had a 52-week low of Rs 292.8. The market cap of NTPC Limited company declined to 3,39,141 Cr during Monday trading today. The Bucks have grown. On Monday, NTPC shares are trading in the range of Rs 324.00-351.40.

NTPC Share Price Target

NTPC Ltd. Macquarie Brokerage Firm Current Share Price Rs. 349.75 Rating BUY Target Price Rs. 475 Upside 35.81%

Monday 7 April 2025 NTPC Share Return

| NTPC Ltd. | Return |

| YTD Return | +5.75% |

| 1-Year Return | +0.83% |

| 3-Year Return | +151.80% |

| 5-Year Return | +463.16% |

Disclaimer: This article is just for information. It should not be treated as investment advice in any way. Investing in the stock market is based on risk. Be sure to consult your financial advisor before investing in the stock market.

Also Read :- GTL Infra Share Price | Market is down, What will happen to GTPL Infra shares?