Vikas Ecotech Share Price : Domestic equity indices BSE Sensex and NSE Nifty50 had started on a negative note on Friday, April 4, 2025, amid mixed cues from the global market. At the closing bell on Friday, April 4, 2025, the BSE Sensex slipped – 930.67 points or – 1.23 per cent to 75364.69 and the NSE Nifty slipped – 345.65 points or – 1.51 per cent to 22904.45.

As of 3.30 pm IST on Friday, April 4, 2025, the Nifty Bank index was down – 94.65 points or – 0.18 per cent at 51502.70. The Nifty IT index was down – 1245.85 points or – 3.72 per cent at 33511.40. However, the S & P BSE SmallCap index declined by – 1626.94 points, or – 3.55 per cent, to 45867.17.

Vikas Ecotech Share Price Today

| Market Cap | ₹433.33 Cr | ROE | 3.05 |

| P/E Ratio (TTM) | 30.63 | EPS (TTM) | 0.08 |

| P/B Ratio | 0.79 | Dividend Yield | 0 |

| Industry P/E | 23.30 | Book Value | 3.11 |

| Debt to Equity | 0.06 | Face Value | 1 |

Saturday 5 April 2025 Vikas Ecotech Share Status

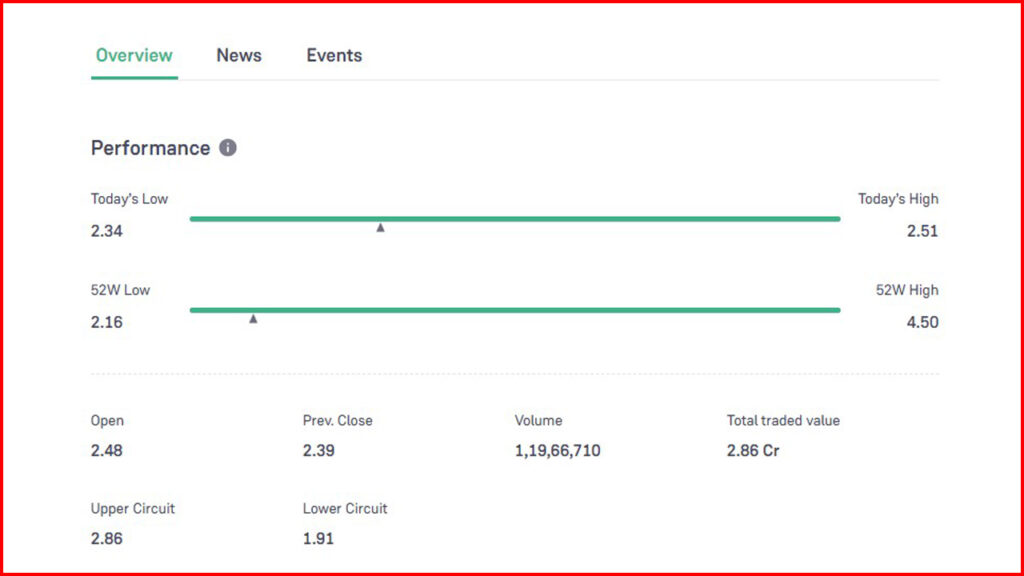

At around 3.30 pm on Friday, the stock of Vikas Ecotech Limited fell by – 2.93 per cent and closed at Rs 2.39. According to the data available on the website of the National Stock Exchange, the Vikas Ecotech Company share opened at Rs 2.48 as soon as trading began at the opening bell on Friday, April 4, 2025. As of 3.30 pm on Friday, April 4, 2025, the Vikas Ecotech Company share had reached the day’s high of Rs 2.51. At the same time, the low level of this share was Rs 2.34 on Friday.

Vikas Ecotech Share Range

According to BSE data, as of Friday, April 4, 2025, Vikas Ecotech Limited Company share had a 52-week high of Rs. 4.5. The stock hit a 52-week low of Rs. 2.16. As of Friday, April 4, 2025, the total market cap of Vikas Ecotech Limited Company has decreased to Rs 423 crore. It has become Rs. Shares of Vikas Ecotech Company were trading in the range of Rs 2.34 – 2.51 on Friday.

Vikas Ecotech Share Price Target

Vikas Ecotech Ltd. Dalal Street Analyst Current Share Price Rs. 2.39 Rating Underperform Target Price Rs. 3.75 Upside 56.90%

Vikas Ecotech Share Return

| Vikas Ecotech Ltd. | Return |

| YTD Return | -23.90% |

| 1-Year Return | -34.59% |

| 3-Year Return | -58.28% |

| 5-Year Return | +209.91% |

Disclaimer: This article is for informative purposes only. It should not be considered as investment advice in any way. Investing in the stock market is based on risk. Consult your financial advisor before investing in the stock market.

Also Read :- IREDA Share Price | PSU Share Target Price Updated, Huge Earning Opportunity